Automation is nothing new in financial services, but our Creditworthiness Assessment Agent in SnapLogic elevates it to a new standard. More than just accelerating processes, it delivers a fully autonomous, rule-based system that evaluates loan applications with unmatched precision, consistency, and transparency. In an industry where trust and reliability are paramount, this agent is redefining how decisions are made, and it’s proving to be a true game-changer.

Why This Matters

Imagine a system that operates like a financial analyst and a loan officer—processing numbers, analyzing cash flows, and making decisions autonomously, without human oversight. That’s our Creditworthiness Assessment Agent. It ingests key inputs like criteria defined by the Bank (or financial institution) that issues the loan and delivers a definitive assessment of Creditworthiness with no ambiguity and no exceptions. The real magic? It’s deterministic—same input, same output, every time. That consistency is a game-changer for auditability, regulatory compliance, and ensuring fairness across thousands of loan applications.

How It Works – Step by Step

Step 1 – Data Ingestion & Retrieval

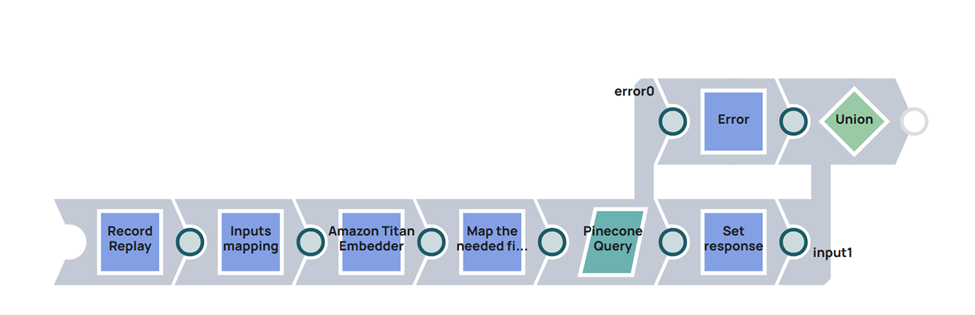

Our retrieval‑augmented generation pipeline uses two separate indexes in Pinecone. The first, company_cash_flows, stores vector representations of multi-year cash‑flow statements provided by the client. The second, bank_policies, holds procedural guidelines for assessing creditworthiness defined by the Bank or financial institution, Basel_III_Thresholds, and other regulatory documents relevant to the loan approval process. By separating financial data from policy rules, we fine-tune relevance within each domain, accelerate retrieval, and simplify re-indexing when regulations change.

SnapLogic orchestrates the end-to-end process: fetching documents, transforming them into structured JSON, and handing them to our decision engine. Every step is logged to ensure full transparency, giving us complete visibility into how decisions are made. The workflow is designed to be fully deterministic—given the same cash flow data and application details, it always produces the same outcome. Consistency and reliability are essential for trust, compliance, and audit readiness.

The result is both technically robust and operationally scalable. Whether we’re handling a single loan application or thousands, SnapLogic ensures the process runs smoothly, delivering accurate, consistent decisions every time.

Step 2 – Deterministic Decision Engine

Here’s where it gets fun. At the heart of the agent is an AI-powered decision engine, hooked up through SnapLogic’s API. It’s not some freewheeling AI throwing out random guesses—this thing follows strict rules:

- Cash Flow Check: Are they bringing in enough to cover the loan? Consistently?

- Debt-to-Income Ratio (DTI): How’s their income stacked against their debts? We’ve got thresholds for that.

- Loan Purpose: Does their plan make sense, or are they just dreaming big with no substance?

- Red Flags: Missing data, weird inconsistencies—anything that smells like risk.

- Collateral: If they’re putting something up, it better be worth at least 125% of the loan amount. Safety first.

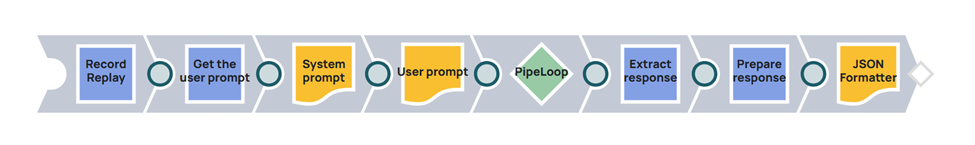

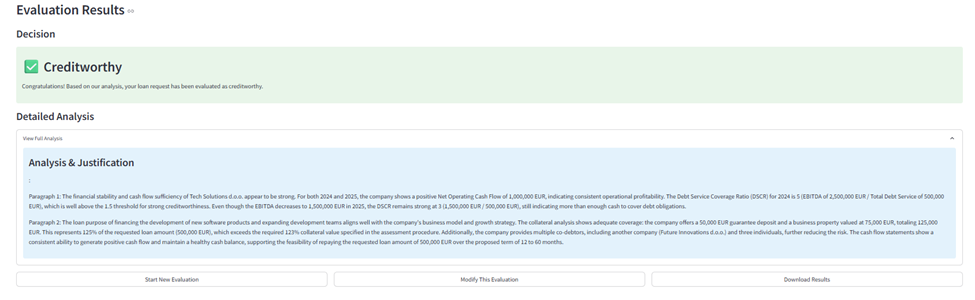

We built it into the system prompt to ensure absolute consistency: “No variation. Same input, same output.” The AI’s temperature? Zero. No creative liberties here. The output’s structured too—decision plus a two-paragraph justification breaking down the financials, the purpose, and any dealbreakers. It’s effectively a roadmap for auditors—transparent, traceable, and built for scrutiny.

Step 3 – Orchestration & Automation

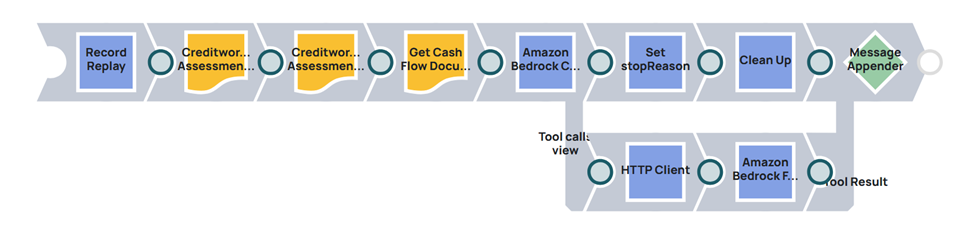

SnapLogic powers our Creditworthiness Assessment Agent with a seamless and innovative approach that keeps our loan evaluation process both smart and dependable. One of the standout features we’re leveraging is Retrieval-Augmented Generation (RAG). With RAG, SnapLogic taps into Pinecone, a cutting-edge vector database, to retrieve critical documents such as cash flow statements and our internal procedure guidelines. These documents form the backbone of our RAG system, ensuring the AI has access to the precise information it needs to make informed decisions for every loan application.

But the power of the platform doesn’t stop there. SnapLogic’s flexible integration capabilities allow it to connect with various external systems—CRM platforms, ERP solutions, financial data providers, and more—to pull in supplementary data relevant to each application. This extensibility enhances decision accuracy and provides a comprehensive overview of the financial position of the loan requester, all within a single, unified workflow.

Interactive Streamlit Front‑End

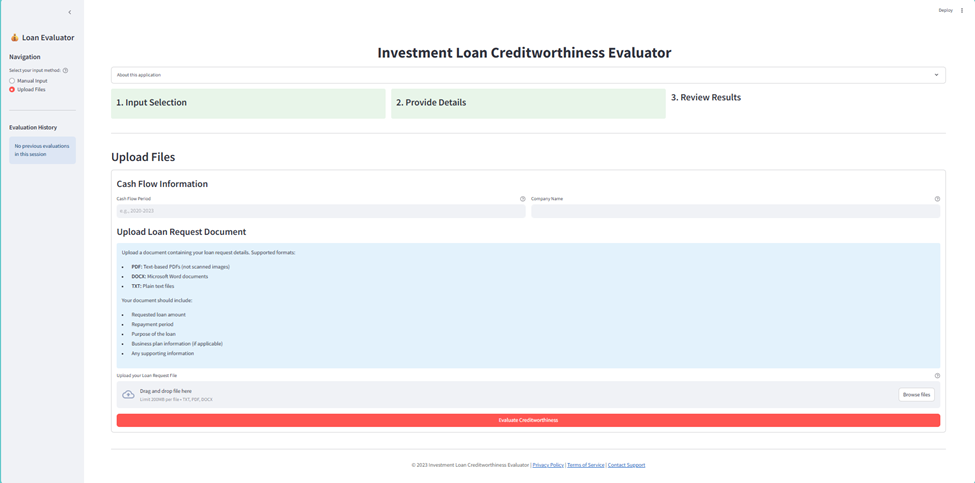

We wrapped the pipeline in a lightweight Streamlit UI that connects to the SnapLogic‑powered API layer to let analysts explore recommendations without leaving their browsers.

The Streamlit dashboard gives credit analysts a clean, single‑page workspace. A collapsible sidebar collects input parameters and documents, while the main canvas streams the decision‑making steps and final recommendation in real‑time. Designed with minimal cognitive load in mind, the layout surfaces only the data points that matter for each assessment stage.

Current Impact

This isn’t just a concept—it’s already delivering real impact. Consistency? Nailed it. Same inputs, same results, every single time. Scalability? SnapLogic’s got our back as loan volumes ramp up. Transparency? Those structured justifications are a compliance officer’s best friend. And risk? With collateral checks and red flag detection, we’re proactively avoiding costly surprises.

The results speak for themselves: our agent is dramatically reducing manual work, minimizing human error, and accelerating decisions — all while keeping the compliance team confident and informed. It’s not just about moving faster; it’s about moving smarter, with a system that’s as reliable as it is revolutionary.

Next Steps

We’re already taking the next step—embedding machine learning to enhance real-time credit risk prediction. We’re implementing feedback loops that allow the system to learn from outcomes and refine decision rules to adapt dynamically. The goal is to reduce manual oversight and increase intelligent automation with every iteration. It’s not a distant vision—it’s the evolution we’re actively driving forward.

Conclusion & Call to Action

Our Creditworthiness Assessment Agent isn’t just a tool—it’s a window into how intelligent automation transforms financial services. It’s fast, auditable, and built to scale, all while delivering decisions with clarity and consistency. We’re excited to keep evolving this capability and would love to engage with other professionals. Have ideas? Feedback? Let’s talk—because collaboration makes the system smarter for everyone.

We’re actively extending the agent with real-time credit line monitoring, fraud-detection signals, and a plug-in framework for adding custom policy modules. Want to learn more about how we’re shaping the future with agents like this? Let’s connect—and let us know what features you’d like to see next.

Authors: Gjorge Argirov and Lazo Ilijoski