In today’s data-centric world, businesses rely heavily on extensive historical records to make informed decisions and maintain their competitive edge. Within the insurance industry, maintaining a complete history of insurance records is not merely a requirement; it’s a strategic advantage. It enables understanding customer trends, tracking policy changes, and ensuring regulatory compliance. However, managing and preserving historical data in the insurance sector presents a complex set of challenges, including volume, diversity, security, integration, compliance, and accessibility.

In this blog post, we will demonstrate how you can harness the power of MuleSoft to seamlessly have a Salesforce to Snowflake integration, thereby significantly enhancing data management within the insurance domain.

The Importance of Salesforce as a Platform

Salesforce stands as the leading CRM platform, widely embraced within the insurance industry, as is the focus of our discussion. However, Salesforce’s native data history tracking feature has its limitations, particularly when it comes to tracking data over extended periods. To overcome this challenge and achieve comprehensive data history tracking, we have strategically chosen to integrate Salesforce with Snowflake, leveraging the capabilities of MuleSoft.

Now, you might wonder if there’s a superior method for achieving comprehensive data history tracking than employing data warehouses.

Why Choose Snowflake for Scaling?

While various data warehouses could serve this purpose, we opted for Snowflake due to its unmatched flexibility in terms of storage scaling, ensuring both optimal performance and cost-efficiency. Although we’ve identified the solution to our data history tracking challenge through Snowflake, there’s still a crucial step ahead: transferring data from Salesforce to Snowflake.

One effective approach to addressing the data transfer challenge is to utilize an integration platform. MuleSoft stands out as an excellent choice for this integration due to its robust capabilities in integration, data transformation, API management, scalability, and customization. Given the capabilities listed above, opting for MuleSoft as our integration solution allows us to achieve the most optimal outcome, hence our selection of this integration platform.

In the discussions that follow, we will focus on a specific type of insurance: car insurance.

A car insurance company encountered issues related to new insurance applications, which were linked to previous applications and had an immediate impact on how the new applications were handled, depending on the outcomes of the past applications. The company had not initially anticipated the historical data requirements, leading to conflicts between the company and its policyholders arising from the numerous new applications.

Faced with this challenge, the company needed to make a swift and intelligent decision on how and where to store all insurance history to prevent future issues. The company utilized Salesforce as its CRM platform and experienced the issues mentioned earlier. The recommended solution, once again, involved using MuleSoft as an integration platform and storing the insurance history in Snowflake.

Salesforce served as a tool for form completion and insurance policy generation. These policies included accident-related details, ensuring the comprehensive capture and centralized storage of crucial information.

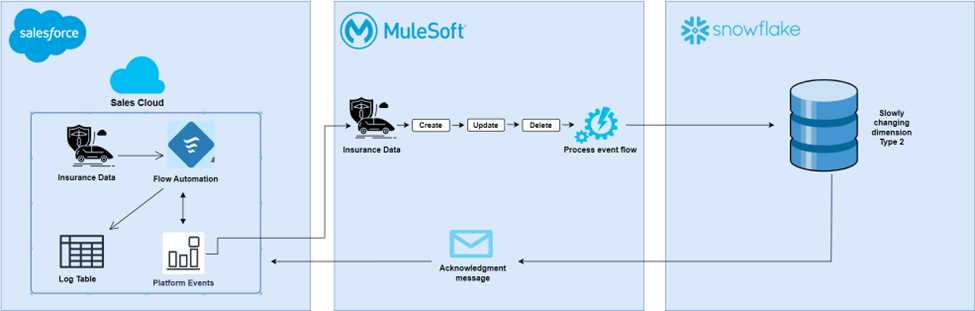

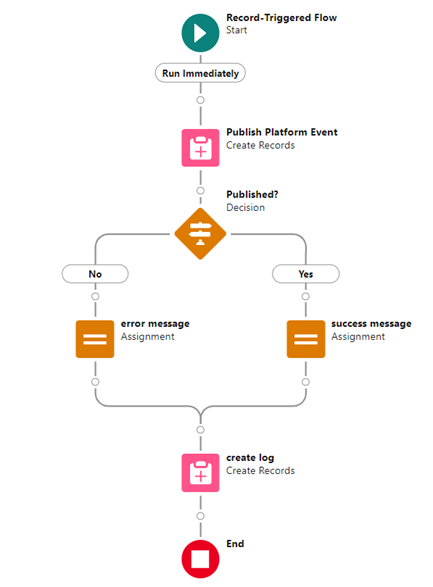

Recognizing the value of automation in simplifying complex processes, we leveraged Salesforce Flows capabilities to automate the entire integration process. Whenever new insurance records were created, updated, or deleted in Salesforce, this automation initiated the transmission of relevant data to an internal streaming channel. A MuleSoft flow maintained an ongoing subscription to this streaming channel, processing the events as needed.

Within the flow, the action involved mapping the insurance data to a platform event, enabling real-time communication. This eliminated manual data handling issues, ensuring the timely and accurate delivery of data to MuleSoft.

Salesforce Platform Events played a pivotal role in our integration strategy. Platform Events is a powerful feature that enable real-time communication between Salesforce and external systems. It facilitated real-time updates by efficiently transmitting crucial data fields to Snowflake, our data warehousing solution. In essence, Salesforce Platform Events acted as a gateway to real-time insights, connecting Salesforce and Snowflake seamlessly.

MuleSoft was instrumental in having a cost-efficient, secure, reliable and optimal way of transmitting the data from Salesforce to Snowflake. The integration was not our ordinary point-to-point data transmission. It utilized the broad capabilities of the platform such as:

- reprocessing of messages

- dynamic routing based on Salesforce events

- sending acknowledgements back to Salesforce for transparency and tracking purposes

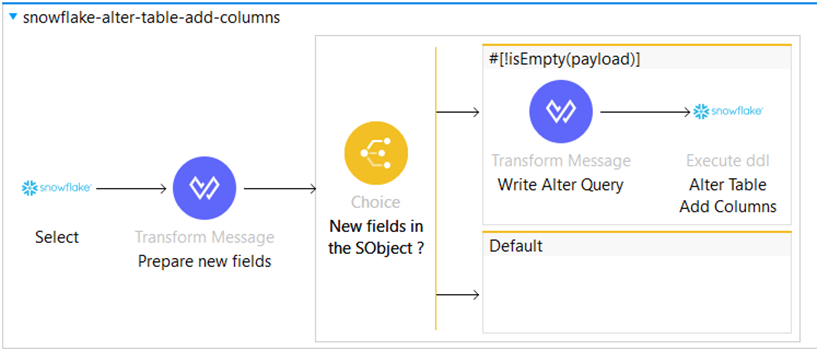

- intelligent altering of Snowflake table structures allowing future-proof Salesforce event updates

MuleSoft provided absolute and instantaneous data synchronization, which is something that organizations look for, in relation to their historical data. Instantaneous data synchronization ensured the history was up-to-date, whenever reporting was being done.

More specifically, MuleSoft implemented the solution for saving the data in Snowflake by using the concept of Type 2 Slowly Changing Dimensions (S2). That allowed for a complete overview of an insurance’s update history from creation, up to closure/deletion, where any update was saved like a snapshot.

Snowflake is extremely capable of achieving parallelism, auto-scaling and auto-suspending and not to mention, is cost-efficient while doing it. When you consider the scaling capabilities and you pair that with MuleSoft’s scaling capabilities, it definitely allowed a virtually unlimited growth while ensuring optimal performance.

Conclusion: Salesforce to Snowflake Integration

In summary, the integration of Salesforce, MuleSoft, and Snowflake enhances insurance data management by providing comprehensive historical data tracking, real-time updates, cost savings, and data-driven decision-making capabilities. This strategic solution bridges customer relationship management and data warehousing, ensuring the insurance company’s success in a data-driven world.

In the case of the company we discussed earlier, we can safely say they managed to capture and preserve car insurance records’ history through the integration improves customer service, streamlines claims processing, supports data-driven decisions, reduces costs, and enhances data security.

These advantages contributed to better tracking of historical data for the company and gave the company a definite edge over its competitors.